Embark on a journey to financial freedom with this Beginner’s Guide to Stock Market Investing. This comprehensive guide is designed to equip aspiring investors with the fundamental knowledge and essential tools needed to navigate the complexities of the stock market. Whether you’re looking to build long-term wealth, secure your retirement, or simply understand the world of stock market investing, this guide will provide you with a solid foundation for success. Learn the basics of investing, from understanding stock market terminology to developing a sound investment strategy. Discover the power of compounding and learn how to make informed investment decisions that align with your financial goals.

This Beginner’s Guide breaks down the intricacies of stock market investing into easily digestible concepts. Explore different investment vehicles, understand market trends, and manage investment risks effectively. Learn how to analyze stocks, evaluate company performance, and make informed decisions about buying and selling. This guide will empower you to take control of your financial future and start your stock market investing journey with confidence. Begin your journey towards financial success today with this invaluable resource for beginner investors.

What Is the Stock Market?

The stock market refers to the collection of exchanges and other venues where the buying, selling, and issuance of shares of publicly held companies take place. Such financial activities are conducted through institutionalized formal exchanges or over-the-counter (OTC) marketplaces which operate under a defined set of regulations. There are a number of stock exchanges around the world, including the New York Stock Exchange (NYSE), the Nasdaq, the London Stock Exchange, and the Tokyo Stock Exchange. These exchanges act as central marketplaces where buyers and sellers can connect and transact business.

When an individual buys stock, they are essentially purchasing a small piece of ownership in a company. This ownership, represented by shares, provides the stockholder with certain rights, including the potential to earn a return on their investment through dividends (a portion of the company’s profits) or through the appreciation of the stock’s value over time. The value of a company’s stock is influenced by numerous factors, including the company’s financial performance, overall market sentiment, and macroeconomic conditions.

Investing in the stock market carries inherent risks. Stock prices can be volatile, meaning they can fluctuate significantly in value. It is crucial for potential investors to do their research, understand their risk tolerance, and potentially consult with a financial advisor before investing. While the stock market offers the potential for substantial gains, it is important to acknowledge the possibility of loss.

Why Invest in Stocks?

Investing in stocks offers the potential for long-term growth. While not without risk, stocks historically have outperformed other asset classes like bonds or savings accounts over extended periods. This potential for higher returns makes stocks an attractive option for building wealth and achieving financial goals like retirement or funding a child’s education.

Stock ownership represents ownership in a company. When you buy a share of stock, you become a partial owner of that business and are entitled to a share of its profits. Companies distribute these profits to shareholders through dividends, which can provide a steady stream of income. Additionally, as a company grows and becomes more profitable, the value of its stock tends to increase, leading to capital appreciation.

Investing in the stock market allows individuals to participate in the overall growth of the economy. As businesses innovate and expand, the stock market tends to reflect this progress. By investing in a diversified portfolio of stocks, individuals can spread their risk and potentially benefit from the long-term upward trajectory of the economy.

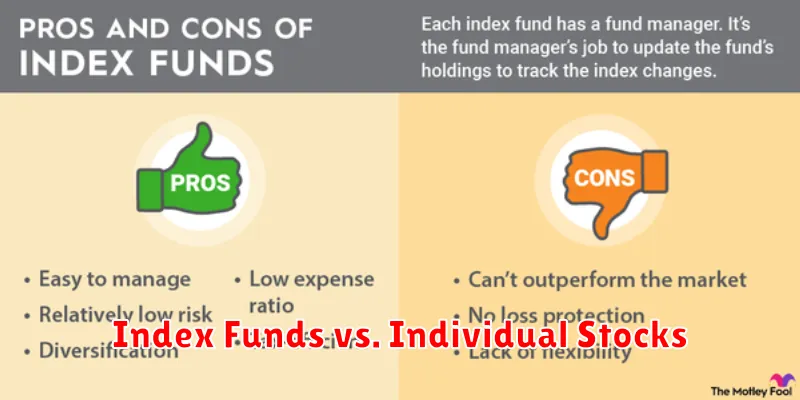

Index Funds vs. Individual Stocks

Choosing between index funds and individual stocks is a crucial investment decision. Index funds offer instant diversification by tracking a specific market index like the S&P 500. This means your investment is spread across numerous companies, reducing the risk associated with any single stock’s performance. They are generally lower cost due to lower management fees and require less research and monitoring. On the other hand, individual stocks offer the potential for higher returns if chosen wisely. However, they come with increased risk as the performance is tied to a single company’s success or failure. Individual stocks necessitate significant research and active management to optimize returns and mitigate risks.

A key difference lies in the management approach. Index funds are passively managed, mirroring the underlying index’s composition, while individual stocks require an active investment strategy. This includes analyzing company financials, market trends, and industry performance. Passively managed funds often outperform actively managed funds over the long term, partly due to lower expense ratios and the difficulty of consistently beating the market.

Ultimately, the best choice depends on your individual investment goals, risk tolerance, and time horizon. If you seek broad market exposure, lower costs, and simplified management, index funds are a suitable option. If you are willing to dedicate time and effort to research and potentially tolerate higher risk for the possibility of higher returns, individual stocks might be more appealing. Many investors diversify their portfolios by including both index funds and individual stocks.

Risks and Rewards Explained

In finance, risk and reward are inherently linked. Risk refers to the possibility of losing some or all of an original investment. The greater the potential loss, the higher the risk is considered to be. Conversely, reward refers to the potential gain from an investment. A higher potential return usually signifies a higher level of risk. Investors must carefully evaluate the balance between risk and reward to make informed decisions aligned with their investment objectives and risk tolerance.

Several factors influence the level of risk associated with an investment. These include market volatility, inflation, interest rates, and the financial health of the issuer (for bonds and stocks). Diversification, the practice of spreading investments across different asset classes, is a common strategy to mitigate risk. While it doesn’t eliminate risk entirely, diversification can help reduce the impact of any single investment’s poor performance on the overall portfolio.

Understanding your personal risk tolerance is crucial. A risk-averse investor prioritizes the preservation of capital and is more comfortable with lower-risk, lower-return investments. A risk-tolerant investor is willing to accept higher levels of risk in pursuit of potentially higher returns. It’s important to assess your own risk tolerance before making any investment decisions.

Opening a Brokerage Account

Opening a brokerage account is the first step to investing in stocks, bonds, and other securities. You’ll need to choose a brokerage firm that suits your needs. Consider factors like fees, account minimums, investment choices, and the available research tools and educational resources. Researching different brokers is crucial to finding the right fit. Some popular options include full-service brokers, discount brokers, and robo-advisors. Each caters to different investor needs and experience levels.

Once you’ve selected a broker, you’ll need to complete an application. This typically involves providing personal information such as your name, address, Social Security number, and employment details. You’ll also need to answer questions about your investment experience and risk tolerance. Be prepared to fund your account. Most brokers require an initial deposit to activate the account. This can be done through electronic transfer, check, or wire transfer. After your application is approved and your account is funded, you can start investing.

Remember to carefully review all account agreements and fee schedules before opening an account. Understanding the terms and conditions is essential to making informed investment decisions. Also, consider setting up two-factor authentication for added security. Protecting your account is paramount in today’s digital landscape.

Long-Term Strategies for Beginners

Beginning investors often feel overwhelmed by the sheer volume of information available. It’s crucial to focus on the fundamentals. Start by defining your financial goals. Are you saving for retirement, a down payment on a house, or your children’s education? Knowing your “why” will guide your investment choices and help you stay focused during market fluctuations. Next, understand your risk tolerance. How much potential loss are you comfortable with? This will determine your asset allocation, the mix of stocks, bonds, and other investments in your portfolio. Finally, keep your costs low by opting for low-expense ratio index funds or ETFs.

Long-term investing is a marathon, not a sprint. Avoid chasing short-term market trends or trying to time the market, which is notoriously difficult even for experienced professionals. Instead, develop a disciplined investing strategy such as dollar-cost averaging, where you invest a fixed amount of money at regular intervals regardless of market conditions. This helps mitigate the risk of investing a lump sum at a market peak. Remember to diversify your investments across different asset classes and sectors to reduce overall portfolio risk.

Patience and consistency are key. Investing success takes time and discipline. Don’t get discouraged by short-term market volatility. Review your portfolio periodically, but avoid making frequent changes based on short-term market movements. Stay informed about market trends and economic conditions, but don’t let fear or greed dictate your investment decisions. If you need help, consider consulting with a qualified financial advisor.

How to Avoid Emotional Investing

Emotional investing occurs when feelings influence investment decisions more than logic and analysis. This can lead to impulsive choices, like buying high out of fear of missing out (FOMO) or panic-selling during market downturns. To avoid this, develop a well-defined investment strategy with clear goals, risk tolerance, and a diversified portfolio. Stick to this plan, regardless of market fluctuations or news headlines.

Research and due diligence are critical for making sound investment choices. Before investing in any asset, understand its fundamentals, including financial performance, industry trends, and competitive landscape. Don’t rely solely on tips or social media hype. Objective data is key to making informed decisions. Set realistic expectations and avoid chasing get-rich-quick schemes. Investing is a long-term game.

If you find yourself struggling to keep emotions out of your investment decisions, consider seeking professional advice. A financial advisor can provide objective guidance, help you develop a personalized investment plan, and keep you accountable to your goals. They can also act as a buffer against emotional reactions to market volatility.