Investing for retirement in your 30s is a critical step towards securing your financial future. While retirement may seem distant, the power of compounding makes these years particularly impactful for building a substantial nest egg. This is the decade where you can truly capitalize on time and consistent contributions to achieve your long-term financial goals. Understanding the importance of retirement planning in your 30s and taking proactive steps can significantly influence your quality of life later on. Choosing the right investment strategies now will lay the groundwork for a comfortable and secure retirement.

This article will explore various investment options suitable for individuals in their 30s, including stocks, bonds, mutual funds, and retirement accounts such as 401(k)s and IRAs. We’ll discuss strategies for balancing risk tolerance with potential returns and provide practical advice for maximizing your retirement savings. Whether you’re just beginning your investment journey or looking to refine your existing portfolio, this guide will offer valuable insights to help you effectively invest for retirement during this crucial decade.

Why Start Investing in Your 30s

Your 30s represent a crucial period for establishing long-term financial security. While retirement may seem distant, the power of compounding makes this decade ideal for beginning or accelerating your investment journey. Starting now allows you to leverage time to your advantage, giving your investments more opportunities to grow exponentially. Additionally, you likely have increased earning potential and more financial stability compared to your 20s, providing a stronger foundation for consistent contributions. Investing in your 30s allows you to build a substantial nest egg to fund future goals, whether it’s retirement, a down payment on a larger home, or your children’s education.

Investing during your 30s provides the opportunity to recover from potential market downturns. While market volatility is inevitable, having a longer time horizon allows you to ride out these fluctuations and benefit from eventual market recovery. This decade also offers a chance to refine your risk tolerance and investment strategy. You can explore various asset classes, diversify your portfolio, and adjust your approach as your financial situation and goals evolve.

Beginning your investment journey now can alleviate future financial stress. By proactively building wealth, you gain greater control over your financial future and reduce the burden of catching up later. Taking the first step is often the most challenging, but establishing a consistent investment habit in your 30s sets the stage for a more secure and comfortable financial future.

Understanding Retirement Accounts (IRA, 401k)

Retirement accounts are crucial for securing your financial future. They offer tax advantages and allow your investments to grow over time, providing income during retirement. Two common types are Individual Retirement Accounts (IRAs) and 401(k) plans. IRAs are independently managed, offering flexibility in investment choices. They come in two main varieties: Traditional IRAs, where contributions may be tax-deductible, and Roth IRAs, where contributions are made after tax but withdrawals in retirement are tax-free. The contribution limits for IRAs are generally lower than 401(k)s.

401(k) plans are employer-sponsored, meaning your employer may offer matching contributions, which is essentially free money towards your retirement. Contributions are made pre-tax, reducing your current taxable income. There are also Roth 401(k) options, mirroring the tax advantages of a Roth IRA. 401(k) plans typically offer a limited selection of investment options chosen by your employer. Understanding the vesting schedule is important, as it dictates when you fully own your employer’s matching contributions.

Choosing the right retirement account depends on your individual circumstances, including your employment status, income level, and retirement goals. Consulting with a financial advisor can help determine the best strategy for your needs. Factors to consider include your risk tolerance, time horizon, and desired asset allocation.

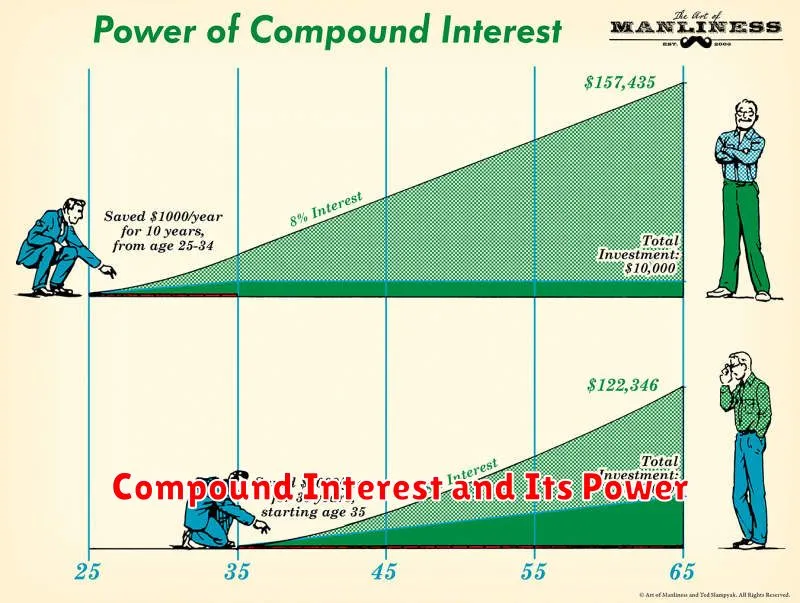

Compound Interest and Its Power

Compound interest is the interest earned not only on the initial principal but also on the accumulated interest from previous periods. This creates a snowball effect, where your money grows at an accelerating rate over time. It differs significantly from simple interest, which is calculated only on the principal amount.

The power of compound interest lies in its ability to generate exponential growth. The frequency of compounding (e.g., daily, monthly, annually) plays a crucial role. More frequent compounding leads to faster growth. The key factors that influence the growth of compound interest are the principal amount, the interest rate, the compounding frequency, and the time horizon. A longer time horizon allows the compounding effect to truly amplify returns.

Understanding and utilizing compound interest is fundamental to building wealth. It’s a key concept in investing and saving, allowing even small initial investments to grow significantly over time. Long-term investment strategies often rely on the power of compound interest to generate substantial returns. This principle underscores the importance of starting early and remaining patient when investing.

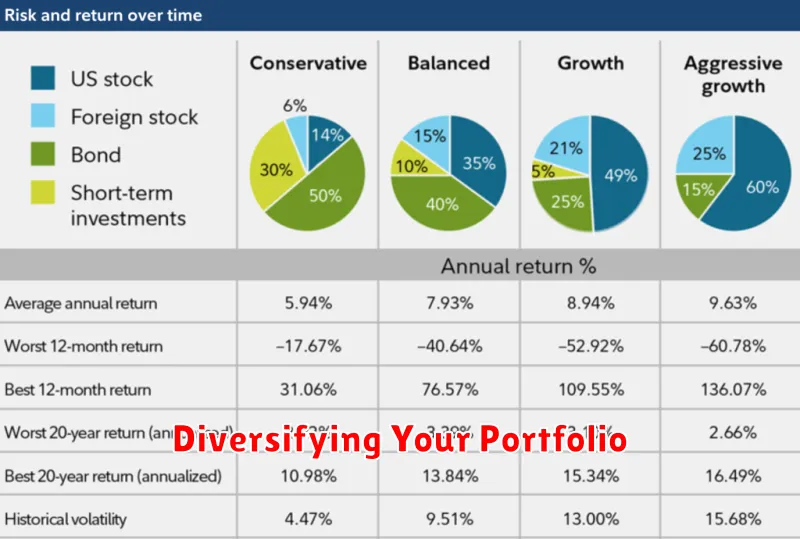

Diversifying Your Portfolio

Diversification is a key strategy in managing investment risk. It involves spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities. By diversifying, you reduce the impact of any single investment’s poor performance on your overall portfolio. This doesn’t guarantee profits, but it can help mitigate potential losses. For example, if the stock market declines, a diversified portfolio with bonds might cushion the blow.

There are various ways to diversify. Within each asset class, you can further diversify by investing in different sectors, industries, and geographic regions. For stocks, this could mean holding shares in technology, healthcare, and energy companies, both domestically and internationally. Similarly, with bonds, you can diversify by maturity date, credit quality, and issuer type (government, corporate, municipal). Determining the right mix of assets depends on individual factors like risk tolerance, time horizon, and financial goals.

Diversification is not a “set it and forget it” strategy. It requires ongoing monitoring and rebalancing. Market fluctuations can shift your portfolio’s asset allocation over time. Rebalancing involves selling some assets that have performed well and buying others that have underperformed to restore your desired allocation. This disciplined approach helps you maintain the intended level of risk and return over the long term.

How Much Should You Invest Monthly

Determining the right monthly investment amount depends on your financial goals, timeline, and risk tolerance. There’s no one-size-fits-all answer, but a common rule of thumb is to invest at least 10% of your gross income. However, depending on your specific goals (like early retirement or buying a house), you might need to invest a significantly larger percentage.

Start by creating a budget to understand your income and expenses. This will help you identify how much you can realistically invest each month. Consider prioritizing high-interest debt repayment before aggressively investing. Even small, consistent contributions can grow significantly over time thanks to the power of compounding. Utilize online calculators or consult with a financial advisor to determine a personalized investment strategy.

Once you have a target amount, automate your investments. Setting up automatic transfers from your checking account to your investment account each month makes investing consistent and effortless. Regularly review and adjust your investment strategy as your financial situation and goals evolve.

Avoiding High-Risk Investments Early On

When starting your investment journey, it’s crucial to prioritize building a strong foundation. This means focusing on lower-risk investments that offer steady, albeit potentially slower, growth. High-risk investments, while potentially offering higher returns, also carry a significantly greater chance of losing your principal. Early in your investing career, preserving capital and developing a consistent saving and investing habit is more important than chasing large, quick gains. This approach allows you to learn market dynamics, build confidence, and gradually increase your risk tolerance as your portfolio grows and your knowledge deepens.

Consider focusing on investments like index funds, exchange-traded funds (ETFs), and bonds. These offer diversification and lower risk compared to individual stocks or more speculative ventures like options trading or cryptocurrency. Building a diversified portfolio across different asset classes helps mitigate potential losses and provides a more stable investment experience. As your experience and financial cushion grow, you can consider allocating a small portion of your portfolio to higher-risk investments.

Remember, investing is a long-term game. Patience and discipline are key to achieving your financial goals. By avoiding high-risk investments early on, you’re setting yourself up for sustainable growth and a more secure financial future.

Planning for Taxes in Retirement

Retirement planning often focuses on savings and investments, but it’s equally crucial to consider the tax implications of your retirement income. Understanding how taxes will affect your withdrawals can significantly impact your overall financial security. Tax-deferred accounts like 401(k)s and traditional IRAs will be taxed upon distribution, while Roth accounts offer tax-free withdrawals in retirement. Considering the tax implications of different account types is essential for maximizing your after-tax income.

Your tax bracket in retirement may be different than your working years. Factors like Social Security benefits, required minimum distributions (RMDs), and pension income can influence your overall taxable income. Estimating your future tax bracket will help you make informed decisions about withdrawals and optimize your tax strategy. It’s wise to consult with a financial advisor to explore strategies for minimizing your tax burden in retirement.

Several strategies can help minimize your tax burden during retirement. For example, strategically withdrawing from different account types (tax-deferred vs. tax-free) can help manage your overall taxable income. Additionally, exploring tax-advantaged investments and considering state taxes in your retirement location can further optimize your tax strategy. Proactive tax planning is key to maximizing your retirement income and achieving your financial goals.