Building an emergency fund is crucial for financial security. Unexpected expenses, such as job loss, medical bills, or car repairs, can quickly derail your finances if you’re not prepared. Having a readily accessible emergency fund can provide a financial safety net, reducing stress and helping you navigate challenging times without accumulating debt. This article provides a comprehensive guide on how to build an emergency fund fast, even if you’re on a tight budget.

Learn how to quickly build an emergency fund by following these practical tips and strategies. Discover how to prioritize saving, cut expenses, and generate extra income to reach your emergency fund goals sooner. We’ll explore various methods to build your emergency fund fast, enabling you to achieve financial peace of mind and be prepared for life’s unexpected turns.

Why You Need an Emergency Fund

Life is unpredictable. Unexpected expenses, such as a sudden job loss, medical emergency, or necessary car repair, can arise at any time. Without an emergency fund, these events can cause significant financial stress, potentially leading to debt accumulation and damage to your credit score. An emergency fund acts as a financial safety net, providing a buffer against these unforeseen circumstances and allowing you to navigate challenging times with greater peace of mind.

Having an emergency fund offers stability and security. It provides the freedom to make necessary choices without resorting to high-interest credit cards or loans. This financial cushion can prevent you from making rash decisions based solely on financial desperation. It also empowers you to handle emergencies promptly, minimizing their impact and allowing you to return to financial stability more quickly.

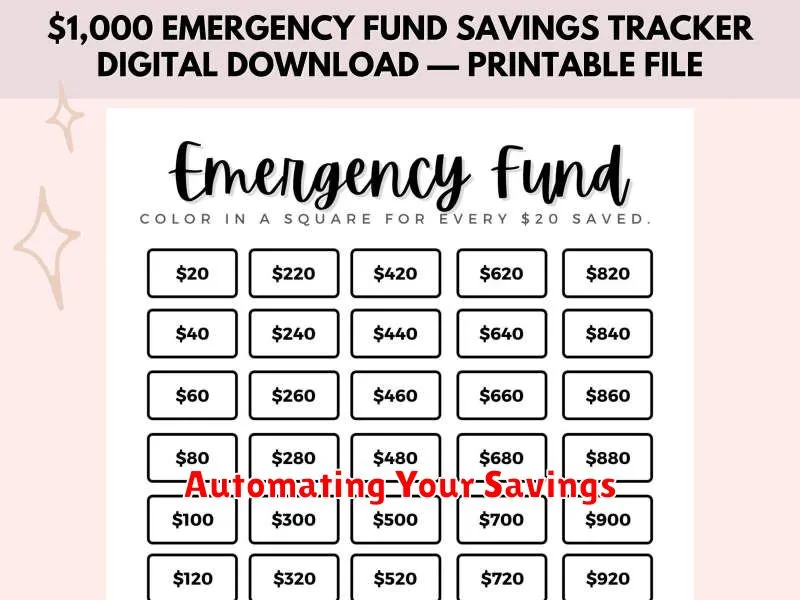

Building an emergency fund requires planning and discipline. While the recommended amount varies, aiming for three to six months’ worth of living expenses is a good starting point. Start small and contribute regularly, even if it’s just a small amount. Over time, these contributions will accumulate, creating a vital resource for navigating life’s unexpected turns and protecting your financial well-being.

How Much Should You Save

Determining the right amount to save depends on individual circumstances and financial goals. A common guideline is the 50/30/20 rule, which suggests allocating 50% of your income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. However, this is a starting point, and individuals may need to adjust these percentages based on their income, expenses, and goals. Higher savings rates are generally recommended for larger purchases like a down payment on a house or for early retirement.

Beyond the general guidelines, consider prioritizing specific savings goals. These could include building an emergency fund, saving for a down payment, investing for retirement, or funding a child’s education. Establishing clear goals can help motivate saving and determine the necessary savings rate. It’s helpful to break down larger goals into smaller, more manageable milestones to track progress and stay motivated.

Finally, it is important to regularly review and adjust your savings plan as your circumstances change. Life events like marriage, having children, or changing jobs can significantly impact your financial situation and require adjustments to your savings strategy. Regularly reviewing your budget and savings goals ensures you stay on track to achieve your financial objectives.

Cutting Daily Expenses

Reducing daily expenses requires a conscious effort and consistent tracking. Begin by identifying non-essential spending, such as frequent takeout meals, subscription services you rarely use, or impulse purchases. Creating a budget, even a simple one, can illuminate areas where you can cut back. This awareness is the first step toward achieving financial savings.

Next, consider practical alternatives to your regular spending habits. Packing your lunch instead of eating out, brewing coffee at home rather than buying it, and using public transportation or carpooling can significantly impact your daily expenditures. Exploring free or low-cost entertainment options, like borrowing books from the library or attending free community events, can also contribute to savings. Small changes implemented consistently can lead to substantial results over time.

Finally, periodically review your expenses to ensure you are staying on track and to identify any new areas for improvement. Adjust your strategies as needed based on your evolving needs and circumstances. Maintaining a proactive approach to managing your daily expenses is essential for long-term financial health.

Automating Your Savings

Automating your savings is a powerful tool for building wealth and achieving financial goals. By setting up automatic transfers from your checking account to a savings or investment account on a regular schedule, you ensure consistent contributions regardless of market fluctuations or personal spending habits. This “set it and forget it” approach removes the temptation to spend money earmarked for savings and promotes disciplined financial behavior.

There are several ways to automate your savings. You can establish recurring transfers through your bank’s online platform, schedule automatic investments with a brokerage firm, or utilize employer-sponsored retirement plans that deduct contributions directly from your paycheck. Choosing the right method depends on your specific goals and financial institutions. Consistency is key, even small, regular contributions add up significantly over time thanks to the power of compounding.

Start small if necessary and gradually increase your automated savings as your income grows. Regularly review your automated system to ensure it aligns with your current financial situation and objectives. Automating your savings not only simplifies the saving process but also instills financial discipline, paving the way for long-term financial success.

Using Side Hustles to Boost Savings

Side hustles offer a powerful way to supplement your primary income and significantly boost your savings. Whether you’re saving for a down payment on a house, paying off debt, or building an emergency fund, the extra cash flow from a side hustle can help you reach your financial goals faster. Choosing the right side hustle depends on your skills, interests, and available time. Some popular options include freelance writing, graphic design, online tutoring, pet sitting, or driving for a ride-sharing service.

Successfully managing a side hustle requires effective time management and organization. It’s crucial to establish a clear schedule and dedicate specific times to your side hustle activities, ensuring it doesn’t negatively impact your primary job or personal life. Carefully track your income and expenses related to your side hustle to accurately assess its profitability. Don’t forget to factor in any associated costs, such as supplies or transportation, to ensure you’re actually making a profit.

Once you start earning from your side hustle, create a dedicated savings plan. Automate regular transfers from your side hustle earnings directly into a savings account. This will help you consistently save without having to think about it. Consider setting specific savings goals and tracking your progress to stay motivated. Even small amounts saved consistently can add up significantly over time, bringing you closer to your financial objectives.

Avoiding Common Saving Mistakes

One of the most common saving mistakes is not having a clear goal. Without a specific objective, like a down payment on a house, retirement, or emergency fund, it’s easy to lose motivation and spend impulsively. Define your saving goals and break them down into smaller, more manageable milestones. This helps you track progress and stay focused.

Another frequent error is underestimating expenses. Many people don’t have a realistic grasp of their spending habits. Track your expenses meticulously for a month or two to identify areas where you can cut back. Budgeting apps can be helpful tools in this process. Once you have a clear picture of your spending, you can create a realistic budget and allocate funds towards savings.

Finally, failing to adjust for lifestyle inflation is a significant mistake. As income increases, it’s tempting to increase spending proportionately. While enjoying the fruits of your labor is important, be mindful of lifestyle inflation. Strive to maintain a reasonable level of spending and increase your savings rate as your income grows. This will help you achieve your financial goals faster and build a stronger financial foundation.

Best Apps for Tracking Emergency Funds

Building an emergency fund is crucial for financial stability. Thankfully, several apps can help you track your progress and stay motivated. These apps often offer features like goal setting, visual progress trackers, and automated savings options to simplify the process. Choosing the right app depends on your individual needs and preferences, so explore a few before committing.

Some popular choices for tracking finances, including emergency funds, are budgeting apps. These apps can often categorize your spending, allowing you to see where your money goes and identify areas for potential savings. They also provide a holistic view of your finances, which can be helpful in determining a reasonable emergency fund goal. Other helpful features might include account aggregation, which allows you to view all your financial accounts in one place, and customized alerts for reaching milestones or dipping below a certain threshold.

Beyond dedicated budgeting apps, consider personal finance apps with savings features. These apps can sometimes offer higher-yield savings accounts specifically designed for emergency funds. Look for features like FDIC insurance to ensure your money is safe. It’s important to note that while some apps offer investment options, a dedicated savings account is generally recommended for emergency funds due to the importance of easy access and capital preservation.