Creating a monthly budget is the cornerstone of sound financial management. A well-structured budget empowers you to take control of your finances, track your spending, and achieve your financial goals. Whether you’re aiming to save for a down payment, pay off debt, or simply gain a better understanding of where your money goes, a working budget is essential. Learn how to create a monthly budget that works for you with this comprehensive guide. We’ll cover key aspects of budgeting, including tracking expenses, setting financial goals, and building a realistic budget that you can stick to.

This guide will provide you with practical steps to build a monthly budget that truly works. We will explore various budgeting methods, discuss the importance of monitoring your spending, and provide tips for staying on budget. From identifying income and expenses to adjusting your budget as needed, we’ll equip you with the knowledge and tools necessary to create a successful budget that will help you achieve financial stability and reach your financial goals.

Understanding Your Income and Expenses

Managing your finances effectively starts with a clear understanding of your income and expenses. Income represents all the money you receive, including salary, wages, investment returns, and any other sources of revenue. Accurately tracking your income is crucial for budgeting and financial planning. Expenses, on the other hand, represent the money you spend. These can be categorized as fixed expenses (e.g., rent, mortgage payments) and variable expenses (e.g., groceries, entertainment). Monitoring your expenses closely helps you identify areas where you can potentially save and optimize your spending habits.

Creating a budget is an essential step in managing your finances. A budget helps you allocate your income towards your expenses and savings goals. Start by listing all your sources of income and then categorize and track your expenses. You can use various tools, such as budgeting apps or spreadsheets, to simplify this process. A well-structured budget empowers you to make informed financial decisions, prioritize your spending, and ensure you’re on track to meet your financial objectives.

Regularly reviewing your income and expenses is vital to maintain financial stability. Compare your actual spending against your budget and identify any discrepancies. This analysis allows you to adjust your spending habits, identify potential areas for savings, and refine your budget over time. By proactively monitoring your finances, you can maintain control over your money and make informed decisions to achieve your long-term financial goals.

Choosing the Right Budgeting Method

Managing finances effectively requires a budgeting method that aligns with your individual needs and financial goals. Several popular methods exist, each offering distinct advantages. The 50/30/20 method allocates 50% of income to needs, 30% to wants, and 20% to savings and debt repayment. This provides a simple framework for balancing essential expenses with personal desires and financial obligations. Zero-based budgeting involves assigning every dollar a purpose, ensuring that income minus expenses equals zero. This detailed approach offers greater control over spending but can be time-consuming. Envelope budgeting involves allocating cash for specific categories in envelopes, limiting spending to the available cash. This tangible method can be particularly effective for curbing overspending in certain areas.

Selecting the right budgeting method depends on your financial personality and lifestyle. If you prefer a simplified approach and have a relatively stable income, the 50/30/20 method may be suitable. For those seeking greater control and detailed tracking of expenses, zero-based budgeting may be a better fit. If you tend to overspend in specific areas, the envelope budgeting system can provide a tangible constraint. Consistency is key regardless of the method chosen. Regularly tracking income and expenses, and reviewing your budget periodically, are crucial for maintaining financial health.

Beyond these common methods, other options include the pay yourself first method, which prioritizes saving a predetermined amount before allocating funds for other expenses, and the value-based budgeting method, which focuses on aligning spending with personal values. Ultimately, the most effective budgeting method is the one you can consistently maintain and that helps you achieve your financial objectives.

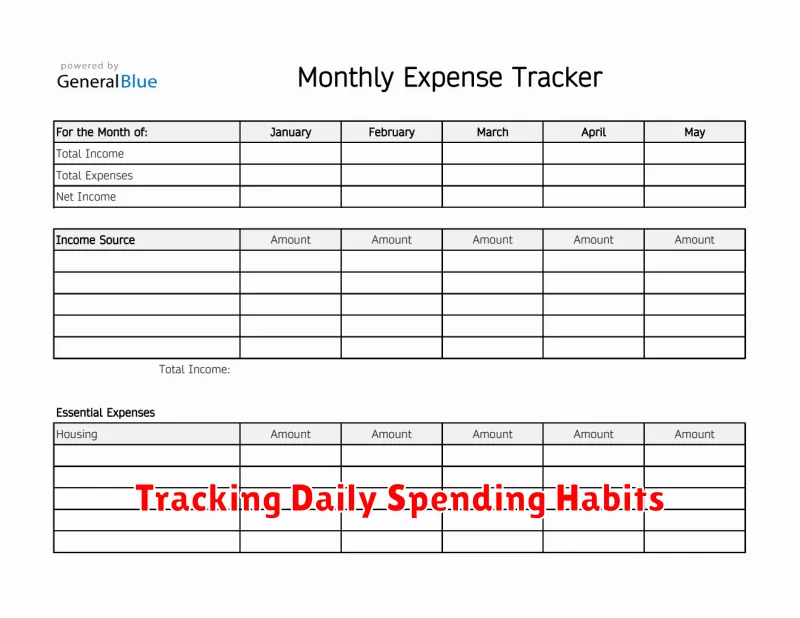

Tracking Daily Spending Habits

Tracking daily spending habits is a crucial step towards achieving financial stability and reaching financial goals. By diligently monitoring where your money goes, you gain valuable insights into your spending patterns, identify areas of potential overspending, and make informed decisions to optimize your budget. This practice allows you to take control of your finances and work towards a more secure financial future.

There are various effective methods for tracking daily expenses. Traditional methods include using a notebook or spreadsheet to manually record each transaction. However, numerous mobile applications and online tools now offer convenient and often automated ways to track spending. These digital tools can link directly to bank accounts and credit cards, automatically categorizing expenses and generating reports. Choosing the right tracking method depends on individual preferences and technological comfort.

Once you establish a consistent tracking system, you can analyze your spending patterns to identify areas for improvement. Look for recurring expenses that can be reduced or eliminated. Consider setting realistic budgets for different categories, such as groceries, entertainment, and transportation. Regularly review your progress and adjust your spending habits as needed to stay on track with your financial objectives.

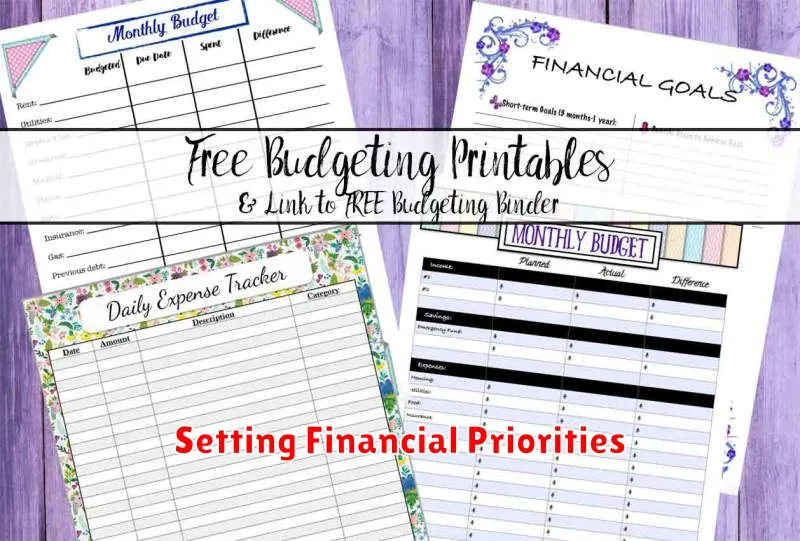

Setting Financial Priorities

Setting financial priorities is crucial for effective money management. It involves identifying your most important financial goals and allocating resources accordingly. This process requires careful consideration of your current financial situation, short-term needs, and long-term aspirations. By prioritizing, you can ensure that you’re focusing on the things that truly matter and making progress toward achieving financial security.

Begin by listing all your financial goals, both big and small. This could include paying off debt, saving for a down payment on a house, building an emergency fund, investing for retirement, or funding your children’s education. Once you have a complete list, rank them in order of importance. Consider factors such as urgency, potential impact on your future, and personal values. Goals related to basic needs and financial security, like having an emergency fund, should generally take precedence.

After prioritizing your goals, develop a realistic budget that aligns with your priorities. Allocate funds toward your top priorities first, then distribute the remaining resources to other goals as feasible. Regularly review and adjust your priorities and budget as your circumstances change. This ongoing process of evaluation and adaptation ensures that you stay on track toward achieving your financial objectives.

Adjusting for Irregular Income

Managing finances with an irregular income can be challenging, but with a few key strategies, you can create a stable budget. Tracking your income and expenses is crucial. Keep detailed records of every dollar earned and spent. This helps you understand your spending patterns and identify areas where you can potentially cut back during leaner months. Creating a realistic budget based on your lowest expected income is also essential. This ensures you can cover your essential expenses even during periods of reduced earnings. Finally, build an emergency fund to cushion against income fluctuations. This fund should cover 3-6 months of essential living expenses, providing a safety net during periods of low or no income.

Consider different budgeting methods to find what works best for you. Zero-based budgeting, where you allocate every dollar to a specific category, can provide a high level of control. Alternatively, the 50/30/20 rule suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. This method offers more flexibility. No matter your chosen method, regularly review and adjust your budget as needed based on your income fluctuations.

Supplementing your irregular income can provide additional financial stability. Explore freelance opportunities or part-time jobs aligned with your skills and interests. These can help bridge income gaps and increase your overall earnings. Remember to factor in any tax implications of additional income sources and adjust your budget accordingly.

Common Budgeting Mistakes to Avoid

One of the most common budgeting mistakes is failing to track expenses. Many people underestimate how much they spend on non-essential items. Without a clear picture of where your money goes, it’s nearly impossible to create a realistic budget and identify areas for potential savings. Tracking your spending, whether through an app, spreadsheet, or even a simple notebook, can provide valuable insights into your financial habits and empower you to make more informed decisions.

Another frequent mistake is creating an unrealistic budget. A budget that’s too restrictive is difficult to maintain and often leads to discouragement and abandonment. Be honest with yourself about your spending habits and create a budget that allows for some flexibility. Prioritize essential expenses like housing and food, then allocate funds for discretionary spending while working towards savings goals. Building in some “wiggle room” can make your budget more sustainable in the long run.

Lastly, neglecting to review and adjust your budget regularly can hinder your progress. Life circumstances change, and your budget should adapt accordingly. Regularly review your income and expenses to ensure your budget still aligns with your financial goals. Perhaps you received a raise or your rent increased – adjust your budget accordingly to reflect these changes and stay on track towards your financial objectives.

Reviewing and Updating Monthly

It’s crucial to review and update your plans, budgets, and progress on a monthly basis. This allows you to stay agile and make necessary adjustments based on performance, market changes, or unforeseen circumstances. Regular reviews help identify potential roadblocks early, ensuring you remain on track to achieve your goals. By consistently monitoring your progress, you can celebrate successes, learn from setbacks, and maintain momentum.

Key areas to focus on during your monthly review include financial performance, sales figures, marketing campaign effectiveness, project milestones, and team performance. Analyzing these areas will provide valuable insights into what’s working, what needs improvement, and where to allocate resources for the following month. This proactive approach fosters continuous improvement and increases the likelihood of long-term success.

Remember to document the key takeaways from your monthly reviews. This creates a valuable record of your progress, decisions, and adjustments, making it easier to track trends and make informed decisions in the future. This documentation also serves as a reference point for future planning and allows for greater accountability.