Are you struggling under the weight of debt? Do you dream of a life free from the stress of owing money? You’re not alone. Millions of people face the challenge of paying off debt, but with the right strategies, you can achieve financial freedom faster than you think. This article will provide you with the best strategies to pay off debt quickly and effectively. We’ll cover proven methods to accelerate your debt repayment journey and empower you to take control of your finances.

From understanding different debt repayment plans like the debt snowball and debt avalanche methods to exploring strategies for increasing your income and cutting expenses, we’ll equip you with the tools you need to conquer your debt and build a secure financial future. Learn how to prioritize your debts, negotiate with creditors, and create a realistic budget that sets you up for success. Take the first step toward a debt-free life by exploring these powerful strategies for paying off debt quickly.

Understanding Your Debt Structure

Understanding your debt structure is crucial for effective financial management. Your debt structure refers to the composition of your outstanding debts, categorized by factors such as interest rates, repayment terms, and the type of debt (secured or unsecured). Analyzing this structure allows you to identify high-cost debts, prioritize repayment strategies, and ultimately, improve your overall financial health. A clear understanding empowers you to make informed decisions about debt consolidation, refinancing, and other debt management strategies.

Key elements to consider when evaluating your debt structure include the total amount of debt owed, the interest rates associated with each debt, the minimum monthly payments required, and the length of the repayment period. By organizing this information, you can gain a comprehensive overview of your debt obligations and identify areas for potential improvement. For instance, you might discover that consolidating high-interest debts into a single loan with a lower interest rate could significantly reduce your overall interest payments.

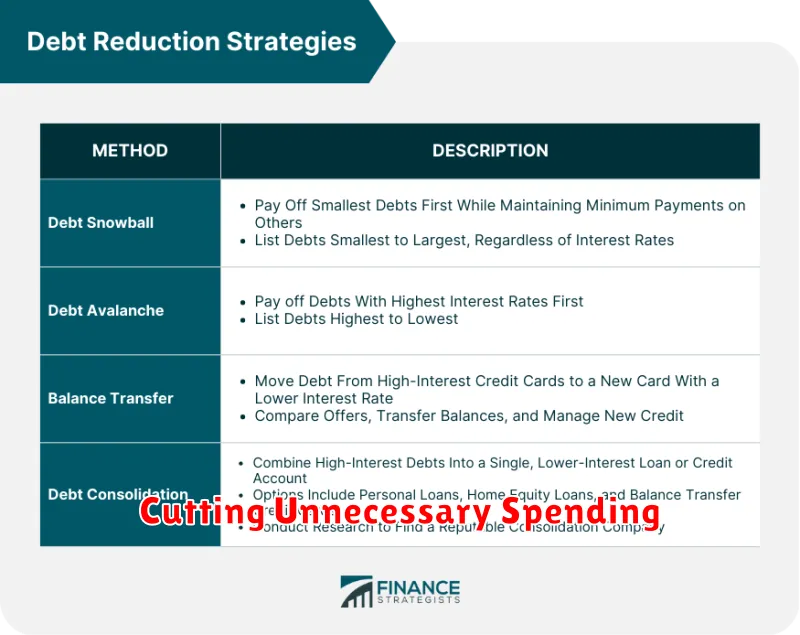

Taking the time to analyze your debt structure is a proactive step towards financial wellness. It allows you to develop a personalized debt management plan tailored to your specific circumstances and financial goals. This plan may involve strategies such as the debt snowball method, the debt avalanche method, or a combination of both. By proactively managing your debt, you can reduce financial stress, improve your credit score, and free up resources for other financial priorities.

Choosing Between Snowball and Avalanche Methods

The snowball and avalanche methods are two popular strategies for tackling debt. The snowball method focuses on building momentum by paying off the smallest debts first, regardless of interest rate. This provides psychological wins, encouraging continued effort. Once the smallest debt is eliminated, the payment amount is then added to the payment for the next smallest debt, creating a “snowball” effect. This method is best suited for those who are motivated by quick progress and need a psychological boost to stay on track.

The avalanche method, conversely, prioritizes debts with the highest interest rates. By tackling high-interest debts first, you minimize the total interest paid over the life of your loans. This method is mathematically the most efficient way to become debt-free, saving you money in the long run. It’s best suited for those who are motivated by logic and maximizing financial efficiency, even if initial progress seems slower.

Ultimately, the best method depends on your individual personality and financial situation. If motivation is your primary concern, the snowball method might be more effective. If minimizing interest payments is your priority, the avalanche method is the better choice.

Creating a Monthly Debt Payment Plan

Developing a structured monthly debt payment plan is crucial for managing finances and achieving financial stability. Start by listing all your debts, including credit cards, loans, and medical bills. Note the outstanding balance, interest rate, and minimum payment for each. Calculate your total monthly debt obligations by summing up all the minimum payments. Comparing this total to your monthly income provides a clear picture of your current debt burden and helps determine how much you can realistically allocate towards debt repayment.

Prioritize your debts using one of two common methods: the debt avalanche or the debt snowball method. The debt avalanche method focuses on paying off high-interest debt first to minimize the total interest paid over time. The debt snowball method targets the smallest debt first, regardless of interest rate, for quicker wins and motivation. Once you choose a method, allocate any extra funds beyond the minimum payments towards your prioritized debt. After paying off one debt, roll over the allocated amount towards the next debt on your list. This creates a “snowball” effect, accelerating your progress.

Consistency is key to a successful debt payment plan. Track your progress regularly to stay motivated and make adjustments as needed. If you find yourself struggling to meet your planned payments, explore options like debt consolidation or balance transfer to lower interest rates and simplify your payments. Remember to consult with a financial advisor if needed for personalized guidance and support.

Cutting Unnecessary Spending

Reducing unnecessary spending is crucial for improving financial stability. It involves consciously evaluating expenses and eliminating those that don’t align with your financial goals or provide significant value. This can range from cutting back on small, recurring expenses like daily coffee purchases to larger expenses like subscription services you rarely use. By carefully examining your spending habits, you can identify areas where you can save money without significantly impacting your lifestyle.

One effective strategy is to create a detailed budget. Track your income and expenses for a month to understand where your money is going. Then, categorize your spending and identify areas where you can make cuts. Prioritize needs over wants. Essential expenses such as housing, food, and transportation should take precedence. Look for opportunities to reduce costs within those categories, such as cooking at home more often or exploring more affordable transportation options. Once your essential needs are met, evaluate remaining expenses and cut those that offer the least value.

Small changes can make a big difference over time. Consider brewing your own coffee instead of buying it daily, canceling unused subscriptions, and taking advantage of free or low-cost entertainment options. Negotiating lower rates for services like internet or insurance can also contribute to significant savings. By implementing these strategies and consistently monitoring your spending, you can gain control of your finances and work towards your financial objectives.

Increasing Your Monthly Payments

Increasing your monthly payments on loans, such as a mortgage or student loans, can significantly reduce the total interest paid over the life of the loan and shorten the repayment period. By paying more than the minimum required amount, you’re applying more money directly to the principal balance, which in turn reduces the amount of interest accrued each month. Even small increases can make a substantial difference over time.

Before increasing your monthly payments, it’s essential to contact your lender to understand their specific procedures. Confirm how extra payments are applied and ensure there are no prepayment penalties. Ask about the option to make bi-weekly payments, as this strategy can result in one extra monthly payment each year, further accelerating your payoff progress.

Carefully assess your budget to determine a sustainable increase in your monthly payments. While aggressive repayment is beneficial, it’s crucial to maintain a balanced budget to avoid financial strain. Start with a manageable increase and gradually increase the amount as your financial situation allows. Prioritize debts with the highest interest rates to maximize savings.

Debt Consolidation Options

Debt consolidation combines multiple debts, like credit cards or loans, into a single, new debt with ideally a lower interest rate or a more manageable payment schedule. This can simplify your finances and potentially save you money on interest. Key considerations when choosing a debt consolidation method include your credit score, the amount of debt you have, and your ability to make consistent payments.

Common debt consolidation options include: balance transfer credit cards, which allow you to transfer high-interest debt to a card with a 0% introductory APR for a limited time; personal loans, which offer a fixed interest rate and repayment term; home equity loans or lines of credit, which use your home as collateral and may offer lower interest rates but risk foreclosure if you default; and debt management plans, which are offered through credit counseling agencies and involve negotiating with creditors to lower interest rates and create a manageable repayment plan.

Carefully consider the pros and cons of each option before making a decision. For example, while balance transfer cards can offer significant interest savings, they often come with balance transfer fees. Personal loans can provide a fixed repayment schedule but require a good credit score. Choosing the right debt consolidation option depends on your individual financial situation and goals.

Tracking Your Progress Over Time

Tracking your progress is crucial for achieving any goal, whether personal or professional. It allows you to see how far you’ve come, identify areas for improvement, and stay motivated. Consistent tracking provides valuable insights into your strengths and weaknesses, helping you refine your strategies and ultimately reach your desired outcome.

There are various methods for tracking progress, including using spreadsheets, journals, apps, or simply noting milestones. The key is to choose a method that is sustainable and easy to maintain. Regularly reviewing your progress, whether daily, weekly, or monthly, will help you stay on track and make necessary adjustments along the way.

Remember to celebrate your successes, both big and small, as you progress. Recognizing your accomplishments boosts motivation and reinforces positive habits, making it easier to stay committed to your goals in the long run. Focusing solely on the end goal can be overwhelming; acknowledging your progress reinforces your commitment and helps maintain momentum.