Setting financial goals is crucial for a secure future, but knowing how to effectively achieve them is just as important. This article provides a comprehensive guide on how to set financial goals that are realistic, measurable, and achievable. Whether your aim is to eliminate debt, build an emergency fund, invest for retirement, buy a home, or simply manage your finances more effectively, this guide will equip you with the knowledge and tools to make your financial dreams a reality. We’ll cover key aspects of financial planning, including budgeting, saving, and investing, to ensure you’re prepared for every step of your financial journey.

From understanding your current financial situation to creating a tailored financial plan, we will delve into the practical steps required to achieve your financial goals. Learn how to prioritize your financial goals, establish a realistic timeline, and track your progress. We’ll also discuss the importance of adapting to unforeseen circumstances and maintaining motivation throughout the process. By implementing the strategies and advice provided in this article, you can take control of your finances and pave the way for a more secure and prosperous future, regardless of your current financial standing.

Why Financial Goals Matter

Setting financial goals is crucial for achieving financial stability and building long-term wealth. These goals provide a roadmap for your finances, helping you prioritize spending, saving, and investing. Without clear objectives, it’s easy to lose sight of your financial aspirations and fall prey to impulsive spending or short-sighted decisions that hinder long-term prosperity. Having specific goals, whether it’s saving for a down payment, paying off debt, or retiring comfortably, provides the motivation and direction needed to make sound financial choices.

Financial goals also provide a framework for measuring progress and making necessary adjustments. By tracking your spending and savings against your defined goals, you can identify areas where you’re succeeding and areas where you need to improve. This allows you to refine your strategies and stay on track. For example, if your goal is to save a certain amount for retirement, regularly monitoring your portfolio’s performance and adjusting your contributions accordingly can help ensure you meet your target. This consistent evaluation process is essential for staying financially disciplined and achieving your desired outcomes.

Ultimately, well-defined financial goals contribute to a sense of financial security and peace of mind. Knowing you’re actively working toward your financial aspirations reduces stress and provides a sense of control over your future. This allows you to focus on other important aspects of your life, knowing you have a plan in place to achieve your financial objectives. Whether your goals involve short-term needs or long-term ambitions, the process of setting and pursuing them fosters a sense of stability and allows you to navigate life’s financial challenges with greater confidence.

Short-Term vs. Long-Term Goals

Short-term goals are objectives you aim to achieve in the near future, typically within a year or less. They serve as stepping stones towards accomplishing larger, long-term goals. Examples include finishing a project, learning a new skill, or saving a certain amount of money. These goals are characterized by their immediacy and provide a sense of accomplishment and motivation as you progress towards your overarching aspirations. They often require less planning than long-term goals and are more easily adaptable to changing circumstances.

Long-term goals, on the other hand, represent your aspirations for the future, typically extending beyond a year. They define your overall direction and purpose, shaping your choices and actions in the present. Examples include earning a degree, buying a house, or establishing a successful career. These goals demand significant planning, dedication, and perseverance. They provide a sense of direction and purpose, guiding your short-term goal setting and motivating you through challenges.

While distinct, short-term and long-term goals are interconnected. Successfully achieving a series of short-term goals contributes directly to the realization of your long-term objectives. The synergy between the two provides a framework for continuous progress and achievement, ensuring that your efforts are aligned with your overall vision for the future.

Using the SMART Goal Framework

The SMART goal framework is a powerful tool for setting effective goals. It ensures goals are Specific, Measurable, Achievable, Relevant, and Time-bound. Defining these parameters clarifies the goal’s objective, provides a method for tracking progress, and ensures the goal aligns with overall strategic objectives.

Each element of the SMART acronym contributes to goal clarity and success. Specificity removes ambiguity, answering the what, why, where, when, and how questions related to the goal. Measurability defines criteria for tracking progress and determining successful completion. Achievability ensures the goal is realistic and attainable given available resources and constraints. Relevance aligns the goal with broader objectives, contributing to overall purpose and strategy. Time-bound establishes a deadline, creating urgency and focus.

By applying the SMART framework, individuals and organizations can significantly improve their chances of achieving desired outcomes. This framework provides a structure for developing well-defined goals, enhancing motivation, and driving progress towards success.

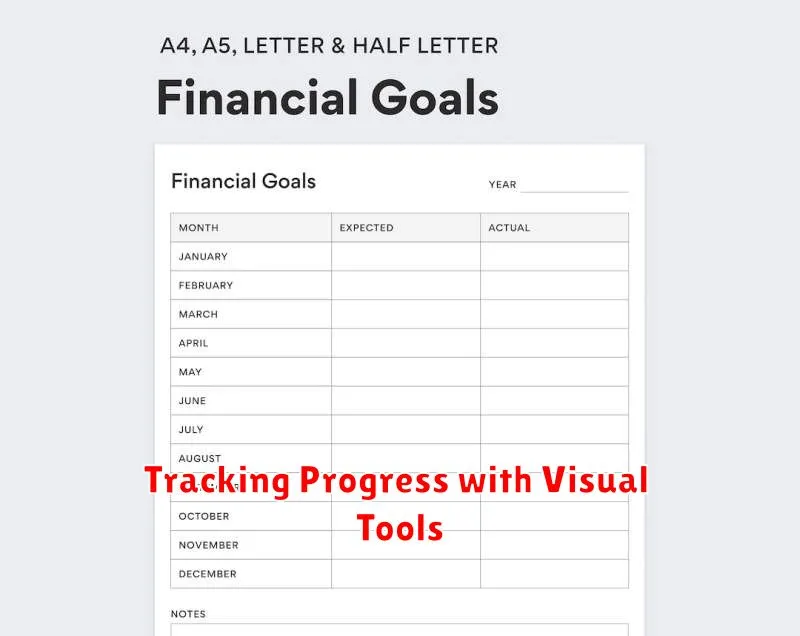

Tracking Progress with Visual Tools

Visual tools offer a powerful way to track progress on projects, goals, and key performance indicators (KPIs). Charts, graphs, and other visual representations make it easier to understand complex data, identify trends, and communicate progress effectively. By transforming raw data into a visual format, these tools provide clear insights that can inform decision-making and drive continuous improvement. Whether tracking individual performance or team milestones, visual tools offer a tangible way to monitor progress and celebrate achievements.

There are a variety of visual tools available, each suited to different needs. Gantt charts are ideal for project management, visually displaying tasks, dependencies, and timelines. Kanban boards facilitate workflow visualization and task management. Dashboards provide a comprehensive overview of key metrics and progress towards goals. Selecting the right tool depends on the specific context and the information being tracked.

The benefits of using visual tools extend beyond simply tracking data. They foster increased engagement by making progress transparent and easily understood. They promote accountability by providing a shared view of performance. Furthermore, they can help identify potential roadblocks and facilitate proactive adjustments to strategies and plans. By leveraging the power of visualization, individuals and teams can gain valuable insights, enhance communication, and achieve greater success.

Adjusting Goals Over Time

Setting goals is important, but equally crucial is the willingness to adjust them over time. Life is dynamic, and circumstances change. Flexibility is key to staying motivated and achieving meaningful progress. As you gain new experiences and knowledge, your priorities and aspirations may evolve. Don’t be afraid to re-evaluate your goals and make necessary adjustments to align with your current situation and long-term vision.

Regularly reviewing your goals is a good practice. Set aside time to reflect on your progress, identify roadblocks, and consider if your goals still resonate with you. Are they still relevant to your broader aspirations? Are they still achievable given your current resources and constraints? If not, don’t hesitate to modify them. This might involve adjusting the timeline, breaking down large goals into smaller, more manageable steps, or even pivoting to a different but related goal.

Adjusting goals isn’t a sign of failure; it’s a sign of growth and adaptability. It demonstrates a willingness to learn and evolve. By embracing change and remaining flexible, you can increase your chances of success and fulfillment in the long run.

Accountability Partners and Support

Accountability partners provide crucial support in achieving goals. They offer encouragement, monitor progress, and help you stay on track. This partnership creates a sense of responsibility and helps combat procrastination and maintain motivation, especially when facing challenges or feeling discouraged. Open communication and shared commitment are essential for a successful partnership.

Finding the right accountability partner is key. Look for someone who is reliable, supportive, and shares similar goals or values. They should be able to offer constructive feedback and encouragement without judgment. A good accountability partner helps you celebrate successes and provides support during setbacks. The relationship should be mutually beneficial, with both partners offering and receiving support.

Effective accountability involves setting clear expectations, establishing regular check-ins, and honestly assessing progress. Partners can use various methods to connect, including in-person meetings, phone calls, video chats, or messaging apps. The frequency and format of these interactions should be agreed upon and adjusted as needed. The ultimate goal is to create a supportive environment that fosters growth and achievement.

Celebrating Small Wins Along the Way

In the pursuit of big goals, it’s easy to get caught up in the enormity of the task and overlook the small victories achieved along the way. Celebrating these small wins is crucial for maintaining motivation and building momentum. Acknowledging progress, no matter how incremental, reinforces positive habits and provides a sense of accomplishment that fuels the drive to continue.

Taking time to recognize small wins can involve various approaches. It might be something as simple as a mental pat on the back, journaling about the achievement, or sharing the success with a friend or colleague. Other strategies include rewarding yourself with a small treat, taking a short break to recharge, or reflecting on the skills and knowledge gained. The key is to find what personally resonates and cultivates a sense of positive reinforcement.

By consistently celebrating small wins, you create a cycle of positive feedback. This helps build resilience, especially when facing setbacks, as you’ve established a foundation of success to draw upon. Ultimately, celebrating small wins fosters a growth mindset and empowers you to approach larger challenges with confidence and sustained enthusiasm.