Are you new to budgeting and feeling overwhelmed? Do you find managing your finances challenging? Don’t worry, you’re not alone! Many beginners struggle with creating and sticking to a budget. This article provides smart budgeting tips specifically designed for beginners, offering practical advice and actionable steps to take control of your finances. Learn how to create a realistic budget, track your spending, and make informed financial decisions. Mastering these budgeting basics will empower you to achieve your financial goals, whether it’s saving for a down payment, paying off debt, or simply gaining peace of mind.

Budgeting for beginners can seem daunting, but it doesn’t have to be. By implementing these simple budgeting tips, you can easily start managing your money effectively. We’ll cover everything from identifying your income and expenses to setting financial goals and choosing the right budgeting method for your needs. Start your journey towards financial wellness today with these essential budgeting tips. Discover how to make a budget that works for you and sets you up for long-term financial success.

Why Budgeting Matters

Budgeting is a crucial tool for achieving financial stability and reaching your financial goals. It provides a clear picture of your income and expenses, allowing you to track your spending, identify areas for improvement, and allocate resources effectively. Without a budget, it’s easy to overspend and accumulate debt, hindering your ability to save for important milestones like a down payment on a house, retirement, or even unexpected emergencies.

Creating a budget helps you make informed financial decisions. By understanding where your money goes, you can prioritize essential expenses and cut back on unnecessary spending. This conscious awareness empowers you to take control of your finances and work towards your goals with purpose. A well-structured budget also allows you to anticipate potential financial challenges and adjust your spending accordingly, providing a sense of security and control over your financial future.

Beyond the practical benefits, budgeting offers a sense of financial peace of mind. Knowing that you have a plan in place to manage your money reduces stress and anxiety related to finances. It empowers you to make confident financial decisions and allows you to focus on your long-term goals without the constant worry of overspending or falling short. Ultimately, budgeting is a powerful tool that allows you to live within your means, save for the future, and achieve financial freedom.

Basic Budgeting Terminology

Understanding basic budgeting terminology is crucial for effective financial management. A budget is simply a plan for how you will spend your money. It involves tracking your income, which is the money you earn, and your expenses, which is the money you spend. Net income is the amount left after subtracting expenses from income. If your net income is positive, you have a surplus, meaning you have money left over. Conversely, if your net income is negative, you have a deficit, meaning you spent more than you earned.

There are different types of expenses to consider when creating a budget. Fixed expenses remain the same each month, such as rent or mortgage payments. Variable expenses fluctuate from month to month, like groceries or entertainment costs. Tracking both types is essential to understanding where your money is going. Budgeting helps you prioritize your spending, save for future goals, and avoid debt.

Several tools and methods can assist with budgeting. You can utilize budgeting apps, spreadsheets, or even pen and paper. Regardless of the method you choose, the key is consistency. Regularly reviewing and updating your budget will ensure it remains relevant and helps you stay on track with your financial goals.

Creating Your First Budget

Creating a budget is the first step towards taking control of your finances. A budget helps you understand where your money is going and allows you to make informed decisions about spending and saving. It doesn’t have to be complicated. Start by tracking your income and expenses for a month to get a clear picture of your current financial situation. This will serve as the foundation for building a realistic and effective budget.

Next, categorize your expenses into needs and wants. Needs are essential expenses such as housing, food, and transportation. Wants are non-essential expenses like entertainment and dining out. Prioritize your needs and identify areas where you can potentially reduce spending on wants. Setting realistic spending limits for each category is crucial for staying within your budget and reaching your financial goals.

Finally, review and adjust your budget regularly. Life changes, and your budget should adapt accordingly. Monitor your progress, identify any discrepancies, and make necessary adjustments to ensure your budget remains aligned with your financial objectives. A budget is a living document, and consistent monitoring and adjustments are key to its effectiveness.

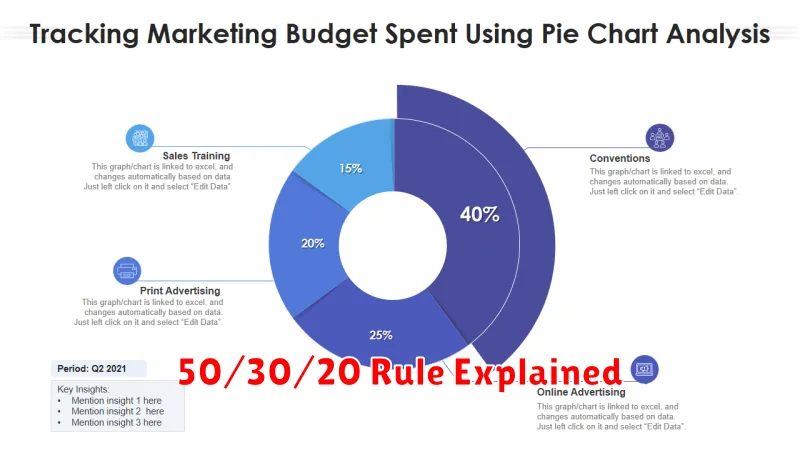

50/30/20 Rule Explained

The 50/30/20 rule is a simple budgeting method that can help you manage your money effectively. It allocates your after-tax income into three main categories: needs, wants, and savings or debt repayment. This framework provides a clear structure for prioritizing expenses and ensuring financial stability.

50% for Needs: This category encompasses essential expenses required for daily living. Examples include rent or mortgage payments, groceries, utilities, transportation, and health insurance. Staying within 50% of your income for these necessary expenses helps maintain a sustainable budget.

30% for Wants: This category covers discretionary spending on things that enhance your lifestyle but aren’t essential for survival. These could be dining out, entertainment, hobbies, travel, or shopping. Allocating 30% allows for enjoyment and flexibility while still maintaining financial discipline. The remaining 20% is designated for savings, such as building an emergency fund, investing, or paying down debt, like credit cards or student loans. This consistent allocation promotes financial security and progress toward long-term goals.

Using Budgeting Apps Effectively

Budgeting apps can be powerful tools for managing your finances. They provide a convenient way to track spending, create budgets, and monitor financial goals. Choosing the right app is key. Consider features like expense categorization, account linking, and reporting capabilities to find one that fits your needs. Data accuracy is crucial. Ensure transactions are categorized correctly and update the app regularly for a clear picture of your finances.

To maximize the benefits of a budgeting app, establish clear financial goals. Whether it’s saving for a down payment, paying off debt, or building an emergency fund, having specific objectives helps you stay motivated and focused. Regularly review your budget and spending patterns. Identify areas where you can reduce expenses and adjust your budget accordingly. Many apps offer personalized insights and recommendations to help optimize your spending.

While budgeting apps offer numerous advantages, it’s important to use them responsibly. Be mindful of security features and choose reputable apps with strong data protection measures. Remember that the app is a tool, and its effectiveness depends on your commitment to using it consistently and accurately. By combining the convenience of technology with disciplined financial habits, budgeting apps can empower you to achieve your financial goals.

Staying Motivated to Stick to a Budget

Sticking to a budget can be challenging, but staying motivated is key to achieving your financial goals. Visualize your goals. Whether it’s a down payment on a house, early retirement, or simply reducing debt, keeping your “why” in mind can fuel your commitment. Track your progress regularly and celebrate milestones, no matter how small. This positive reinforcement will help you stay engaged and motivated to continue budgeting.

Make budgeting a habit by incorporating it into your daily or weekly routine. Use budgeting apps or spreadsheets to simplify the process and make it less daunting. Find a budgeting method that works for you. Experiment with different approaches, such as the 50/30/20 rule or zero-based budgeting, until you find one that aligns with your spending habits and financial goals.

Don’t be afraid to adjust your budget as needed. Life throws curveballs, and your budget should be flexible enough to accommodate unexpected expenses or changes in income. Remember, budgeting is a journey, not a destination. There will be times when you slip up, and that’s okay. The important thing is to learn from your mistakes and get back on track as quickly as possible.

Adjusting Your Budget as Life Changes

Life is full of changes, and those changes often impact our finances. Whether it’s a new job, marriage, a growing family, or retirement, adjusting your budget is crucial to maintaining financial stability. Evaluate your income and expenses regularly to identify areas where you can save or need to allocate more funds. For example, a new baby might mean increased spending on childcare and diapers, requiring adjustments in other areas like entertainment or dining out. Similarly, a job change, even a positive one with a salary increase, may necessitate changes in your tax withholdings and retirement contributions.

Creating a flexible budget can help you navigate these life transitions more smoothly. Build in a buffer for unexpected expenses and consider using a budgeting app or spreadsheet to track your spending and make adjustments as needed. Prioritize your essential expenses like housing, food, and transportation, and then allocate funds towards other goals, such as debt repayment or saving for a down payment. Be prepared to reassess your priorities as your circumstances change. For instance, paying off high-interest debt might take precedence over saving for a vacation when facing a job loss.

Seeking professional financial advice can also be beneficial, especially during significant life changes. A financial advisor can help you create a personalized plan, manage investments, and navigate complex financial situations. They can also offer guidance on topics like insurance, estate planning, and retirement planning. Remember, adapting your budget to life’s changes is an ongoing process that requires consistent monitoring and adjustments to ensure your financial well-being.